Many online players are stepping out to aggressively advertise on traditional media to get more business

What is common to Flipkart, Olx, Quikr, Yehbhi and Communitymatrimony apart from the fact that they are online brands? Well, they all share ad space with the Pepsis, the Cokes and the Airtels of the world on television. And are equally visible on print too.

What is common to Flipkart, Olx, Quikr, Yehbhi and Communitymatrimony apart from the fact that they are online brands? Well, they all share ad space with the Pepsis, the Cokes and the Airtels of the world on television. And are equally visible on print too.According to industry estimates, in the last two years, online companies have increased their ad spends on TV by a staggering 445 per cent. In 2009, online companies together spent Rs 58.4 crore on television. That figure leapt to Rs 201 crore in 2010. This year, in just ten months (January to October) ad spends by online brands have raced way past the previous year's figure to Rs 315 crore. At this rate they could end up close to Rs 400 crore for 2011-more than six times that were spent two years ago.

The story is no different when it comes to advertising in print media. It's estimated that online brands occupied print ad space worth close to Rs 266 crore between January and October. Radio is smaller, but spends still went up from Rs 4.5 crore in 2009 to Rs 7.7 crore in 2010. This year (January-October), that figure has almost quadrupled to Rs 30 crore. These figures, however, do not include spends by media houses-or their associate companies-which use their own media, be it print, television or radio.

An example of the above would be the Times Group properties like Magicbricks or Indiatimes. The advertising spends against some of their names are so stupendous that only a media-linked or owned brand would have spent that kind of money. Naaptol (that had a private equity deal with the Times Group some time ago), for instance, consumed print media space worth Rs 555 crore this year. Leaving them out might be unfair but including their advertising spends would certainly distort the real picture.

What is it that is pulling so many new age companies to use traditional media to showcase themselves?

Inspired move

It was Naukri.com that started it all. Way back in 2004, it came up with its first TVC that had a painful, irritating boss at the centre of things. Two years after this came the unforgettable Hari Sadu TVC. After a hiatus, Hari Sadu made a comeback in 2010 and took the stage by storm again. Bharatmatrimony was another online pioneer that went the TV commercials way to spread its message.

Success stories like these sparked off an offline advertising rush among digital brands. For long, digital brands were quite happy about using the online medium to generate leads and invite potential customers on to their respective websites. As the search for new customers and brand building intensified, they moved to the traditional advertising route.

Today, most online companies spent 20-30 per cent of their total advertising and marketing budgets online. The rest goes into traditional media. Ravi Vohra, vice president (marketing), Flipkart, one of the largest advertisers on TV among online brands, says, "Traditional media helps create a feeling of reliability and authenticity amongst consumers." Is this trend the proverbial flash in the pan? No, believe industry experts. They opine that this trend is here to stay and will continue to grow together with the digital business.

Today, most online companies spent 20-30 per cent of their total advertising and marketing budgets online. The rest goes into traditional media. Ravi Vohra, vice president (marketing), Flipkart, one of the largest advertisers on TV among online brands, says, "Traditional media helps create a feeling of reliability and authenticity amongst consumers." Is this trend the proverbial flash in the pan? No, believe industry experts. They opine that this trend is here to stay and will continue to grow together with the digital business.It is easier now

Brands such as Naukri and Bharatmatrimony belong to the era of the dotcom boom, and they had their own set of challenges. Not every online brand could afford to advertise on mass media back then. It is different now.

Brands such as Naukri and Bharatmatrimony belong to the era of the dotcom boom, and they had their own set of challenges. Not every online brand could afford to advertise on mass media back then. It is different now. According to Murugavel Janakiraman, founder and CEO, Consim Info (that owns properties such as Bharatmatrimony and Clickjobs), it took the company a long time before it launched its first campaign on television and other media because of a limited budget. He reminisces, "It was only after we got funding that we were able to launch our first campaign on television. The difference between then and now is that today it is easy to get funding, which in turns helps in building strong brands through offline advertising." True, but the pace has been quite surprising.

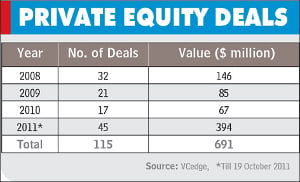

According to Murugavel Janakiraman, founder and CEO, Consim Info (that owns properties such as Bharatmatrimony and Clickjobs), it took the company a long time before it launched its first campaign on television and other media because of a limited budget. He reminisces, "It was only after we got funding that we were able to launch our first campaign on television. The difference between then and now is that today it is easy to get funding, which in turns helps in building strong brands through offline advertising." True, but the pace has been quite surprising. While things have moved fast in the last few years, the rate of acceleration has changed sharply in the last one year. According to VC Edge (a data service from VC Circle), between 2008 and 2011, online companies received investments of $691 million (Rs 3,455 crore). Interestingly, more than 50 per cent of this-$394 million (Rs 1,970 crore)-came in 2011 alone.

While things have moved fast in the last few years, the rate of acceleration has changed sharply in the last one year. According to VC Edge (a data service from VC Circle), between 2008 and 2011, online companies received investments of $691 million (Rs 3,455 crore). Interestingly, more than 50 per cent of this-$394 million (Rs 1,970 crore)-came in 2011 alone. E-commerce businesses have hogged the bulk of all investments between 2008 and 2011. They accounted for 90 of the 115 deals in this while and attracted investment of $453 million (Rs 2,265 crore) of the total $691 million that flowed into online companies-or two thirds of the total. If you include travel sites as a form of e-commerce, throw in another 16 deals worth $149 million (Rs 745 crore). What explains this fascination with e-commerce companies?

E-commerce businesses have hogged the bulk of all investments between 2008 and 2011. They accounted for 90 of the 115 deals in this while and attracted investment of $453 million (Rs 2,265 crore) of the total $691 million that flowed into online companies-or two thirds of the total. If you include travel sites as a form of e-commerce, throw in another 16 deals worth $149 million (Rs 745 crore). What explains this fascination with e-commerce companies? Investor interest is fuelled by a number of factors. First, the Indian economy has been growing at 7-8 per cent per annum, and is expected to continue doing that for many years to come. Apart from the economic factors, this is being aided by a particular moment in the country's demographic history when the working Indians as a percentage of total population is at a happy high: in other words, dependents (both old and young) are relatively few. A high proportion of working people is a near-guarantee of continuous growth under the right circumstances.

Investor interest is fuelled by a number of factors. First, the Indian economy has been growing at 7-8 per cent per annum, and is expected to continue doing that for many years to come. Apart from the economic factors, this is being aided by a particular moment in the country's demographic history when the working Indians as a percentage of total population is at a happy high: in other words, dependents (both old and young) are relatively few. A high proportion of working people is a near-guarantee of continuous growth under the right circumstances. Besides, statistical predictions show that online addicts will only grow exponentially. According to the latest reports from IAMAI, India is adding 5-7 million internet users every month, most of them in small towns and among the less-wealthy.

Besides, statistical predictions show that online addicts will only grow exponentially. According to the latest reports from IAMAI, India is adding 5-7 million internet users every month, most of them in small towns and among the less-wealthy.  E-commerce companies are counting on the fact that the growth of media has created a desire to consume, which has spread beyond the metros into smaller town India. However, modern retail has not been able to keep pace with demand-in large part because of India's crazily expensive retail real estate rentals. In contrast, the internet, and especially mobile internet, is expected to record explosive growth (but with just 8 million users, mobile internet hasn't taken off). In conclusion, goes the investor logic, the e-commerce companies would be perfectly placed to capitalise on the boom in consumption, especially beyond the metros.

E-commerce companies are counting on the fact that the growth of media has created a desire to consume, which has spread beyond the metros into smaller town India. However, modern retail has not been able to keep pace with demand-in large part because of India's crazily expensive retail real estate rentals. In contrast, the internet, and especially mobile internet, is expected to record explosive growth (but with just 8 million users, mobile internet hasn't taken off). In conclusion, goes the investor logic, the e-commerce companies would be perfectly placed to capitalise on the boom in consumption, especially beyond the metros. While heavy funding has allowed companies to advertise on mass media, a cynical explanation to this whole game of advertising and marketing is that it enables online brands impress their investors as well. This, in turn, helps them increase their valuation.

|

According to the latest report released by IAMAI, the number of Internet users is 112 million. As a statistic, that sounds quite impressive. However, the fact is that it is still less than 10 per cent of the country's overall population. Of the 112 million, 88 million come from urban cities and 24 million from the country's numerous villages and small towns.

Anita Nayyar, CEO (MPG India and South Asia), states that, with more and more online brands trying to grab the attention of the mass, the objective is to create an instant impact. She adds, "At the time of launch, an online brand can be seen everywhere be it television, print or radio. So, while TV and print provide the big reach, radio acts as a reminder medium, which is why the medium is used again and again."

Says Shashank Mehrotra, head-marketing, sales and strategic partnership, BigRock, a web services provider, "The awareness level for online companies is very low. Hence, traditional medium acts as a medium of evangelism. Moreover, the process of educating the customer also helps break the old mind-set and apprehension that a customer has while making any purchase online."

The need for educating the consumer is far more when it's a new category and the onus is always on the first mover. Akshay Mehrotra, chief marketing officer, PolicyBazaar.com, says, "Most e-businesses are first in the category. And, the first mover needs to spend heavily in building the category." Citing his own brand, he notes, "We were the first online insurance player to go on television. Our task was simpler-we only had to ask our audience to compare insurance models and then decide to buy."

Will online brands constantly keep hiking advertising spend as they go along? According to observers, in the first year of its launch, a major online brand would spend about Rs 30 crore, per annum. In the second, it is reduced to half of that.

Spends continue to drop in the subsequent years and will be driven by specific offers and reminders

There is a plan

Out of the Rs 300-odd crore that's spent by the online companies on television, 50 per cent comes from the online ecommerce players. As it happens, an e-commerce and deals site targets consumers between 18 and 45 years of age.

These brands not only need to be on television but also place themselves on general entertainment channels (GECs) - that's where the age spread is the most-although it pushes up spends as general entertainment channels turn out to be an expensive proposition.

As Pratik Mazumdar, head marketing and strategic relations, Yatra remarks, "At present, there are over 100 million internet users in the country. However, there is also a wide swathe of potential consumers between 25-45 years of age who remain untapped so far. That is the segment most brands are targetting Therefore, a mass-media campaign helps us in targeting the entire existing consumer base as well as help in getting new consumers on to the site."

Advertising online may be more effective because all it takes to bring a consumer to your site is a click on the link-and is much less expensive than advertising on television.

Moreover, in the case of offline advertising, there is a danger that the target audience may forget about it all after the ad has been viewed. However, the surge in traditional advertising just goes to show that online brands are willing to sacrifice something to get a slice of the larger pie.

Moreover, in the case of offline advertising, there is a danger that the target audience may forget about it all after the ad has been viewed. However, the surge in traditional advertising just goes to show that online brands are willing to sacrifice something to get a slice of the larger pie.

(Based on more interviews with Ajit Varghese, managing director- South Asia, Maxus and Motivator; Debraj Tripathy, managing director, Mediacom; Hitesh Oberoi, chief executive officer and managing director, Info Edge; Jibi Thomas, co-founder, Quikr; Kartik Iyer, managing director, Carat Media; Mohit Gupta, chief marketing offier, MakeMytrip, Naresh Gupta, chief strategy officer, iYogi, Sudha Natrajan, deputy CEO, Lintas Media; Roopam Garg, chief operating officer, ZenithOptimedia)

(Source -: mintlive.com)